Transaction Advisory Services Can Be Fun For Anyone

Wiki Article

Examine This Report on Transaction Advisory Services

Table of ContentsSome Known Factual Statements About Transaction Advisory Services More About Transaction Advisory ServicesGetting The Transaction Advisory Services To WorkThe Definitive Guide to Transaction Advisory ServicesTransaction Advisory Services Things To Know Before You Buy

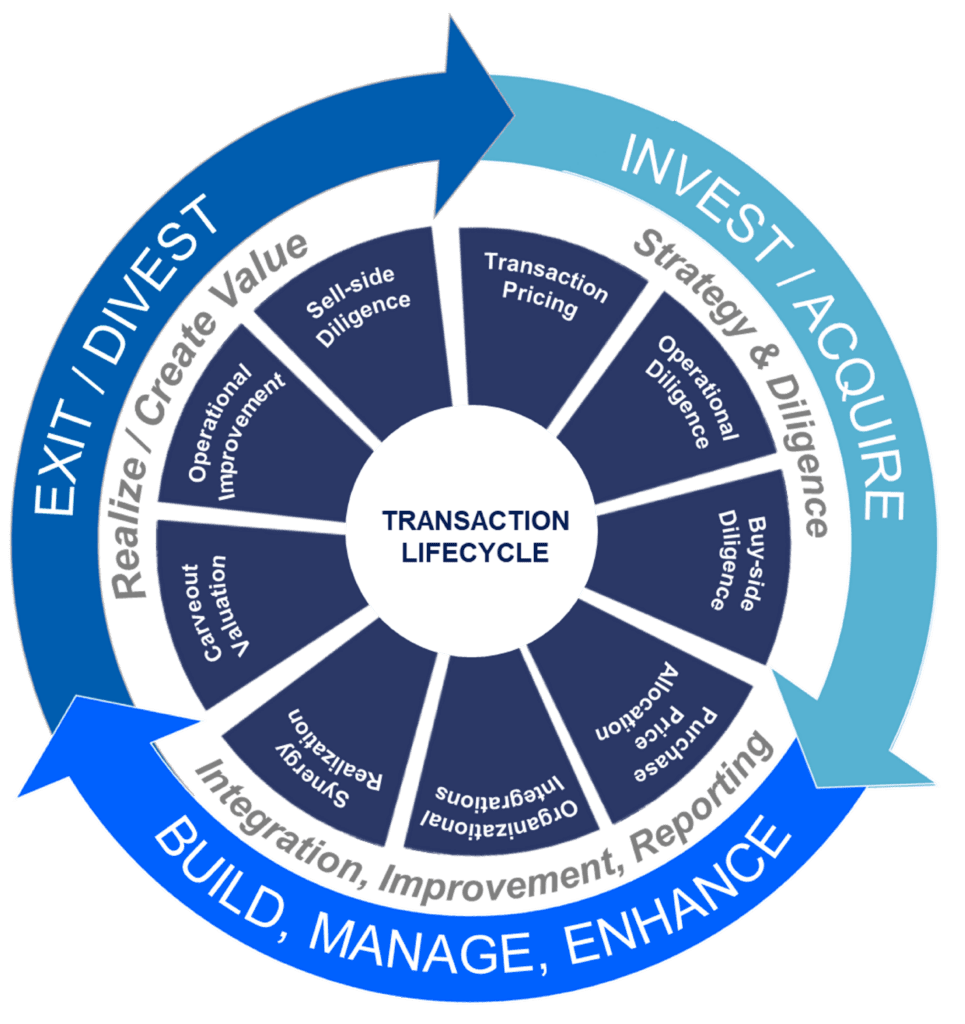

This step makes certain business looks its best to prospective customers. Obtaining the company's worth right is essential for a successful sale. Advisors utilize different methods, like discounted capital (DCF) evaluation, comparing to similar firms, and recent purchases, to identify the reasonable market value. This helps establish a fair price and work out efficiently with future buyers.Transaction advisors action in to help by getting all the required details arranged, answering questions from buyers, and setting up brows through to the service's location. Purchase consultants utilize their competence to help organization proprietors take care of tough negotiations, meet purchaser assumptions, and structure deals that match the proprietor's goals.

Fulfilling legal rules is crucial in any kind of service sale. They aid business owners in intending for their following actions, whether it's retired life, beginning a brand-new venture, or handling their newly found wide range.

Transaction consultants bring a wide range of experience and knowledge, making certain that every aspect of the sale is managed properly. With strategic prep work, assessment, and settlement, TAS helps entrepreneur accomplish the greatest feasible sale cost. By making sure legal and regulative conformity and handling due diligence alongside other bargain staff member, purchase consultants lessen possible threats and obligations.

The Greatest Guide To Transaction Advisory Services

By comparison, Big 4 TS groups: Work with (e.g., when a prospective customer is performing due persistance, or when an offer is closing and the buyer needs to integrate the business and re-value the vendor's Balance Sheet). Are with fees that are not linked to the deal shutting successfully. Earn charges per interaction somewhere in the, which is much less than what investment banks earn even on "little deals" (but the collection likelihood is also a lot greater).

, but they'll concentrate much more on accountancy and appraisal and less on subjects like LBO modeling., and "accountant just" topics like test balances and how to stroll via events making use of debits and credit reports rather than monetary statement changes.

The Of Transaction Advisory Services

that demonstrate exactly how both metrics have actually transformed based on products, networks, and clients. to judge the precision of monitoring's previous forecasts., including aging, inventory by item, average levels, and arrangements. to establish whether they're entirely imaginary or rather credible. Experts in the TS/ FDD teams may also speak with management regarding whatever over, and they'll create a comprehensive report with their searchings for at the end of the procedure.The hierarchy in Purchase Solutions differs a little bit from the ones in investment banking and personal equity occupations, and the basic shape looks like this: The entry-level duty, where you do a great my blog deal of information and financial analysis (2 years for a promotion from right here). The next level up; similar job, yet you get the even more intriguing little bits (3 years for a promo).

Particularly, it's challenging to get advertised beyond the Supervisor degree because couple of people leave the job at that stage, and you click to investigate require to begin revealing proof of your capability to generate income to breakthrough. Allow's begin with the hours and way of life considering that those are easier to describe:. There are occasional late evenings and weekend job, yet absolutely nothing like the frenzied nature of investment banking.

There are cost-of-living modifications, so expect reduced settlement if you're in a more affordable place outside significant financial (Transaction Advisory Services). For all placements except Companion, the base pay comprises the bulk of the complete compensation; the year-end bonus may be a max of 30% of your base wage. Commonly, the best method to boost your profits is to switch over to a different company and bargain for a greater salary and bonus offer

6 Simple Techniques For Transaction Advisory Services

You could enter business development, yet financial investment financial obtains harder at this phase due to the fact that you'll be over-qualified for Analyst duties. Business money is still an option. At this stage, you must simply stay and make a run for a Partner-level duty. If you wish to leave, perhaps transfer to a customer and execute their valuations and due diligence in-house.The main problem is that due to the fact that: You typically require to join an additional Huge 4 team, such as audit, and job there for a few years and afterwards move right into TS, work there for a few years and afterwards move into IB. And there's still no assurance of winning this IB duty due to the fact that it relies on your area, customers, and the hiring market at the time.

Longer-term, there is also some risk of and because assessing a business's historic financial information is not specifically brain surgery. Yes, human beings will constantly need to be included, however with even more innovative modern technology, lower headcounts can potentially sustain customer this engagements. That stated, the Purchase Solutions team beats audit in regards to pay, job, and departure opportunities.

If you liked this short article, you might be thinking about reading.

Transaction Advisory Services Fundamentals Explained

Establish sophisticated economic frameworks that aid in determining the actual market price of a firm. Give advising operate in relation to organization evaluation to assist in bargaining and rates structures. Clarify the most appropriate type of the deal and the sort of factor to consider to utilize (cash money, supply, make out, and others).

Do assimilation preparation to determine the process, system, and organizational modifications that may be required after the bargain. Set guidelines for integrating departments, technologies, and service procedures.

Identify possible decreases by reducing DPO, DIO, and DSO. Examine the prospective consumer base, industry verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence supplies vital insights into the performance of the firm to be obtained worrying risk assessment and worth production. Identify short-term modifications to finances, financial institutions, and systems.

Report this wiki page